Business Tax Preparation Services

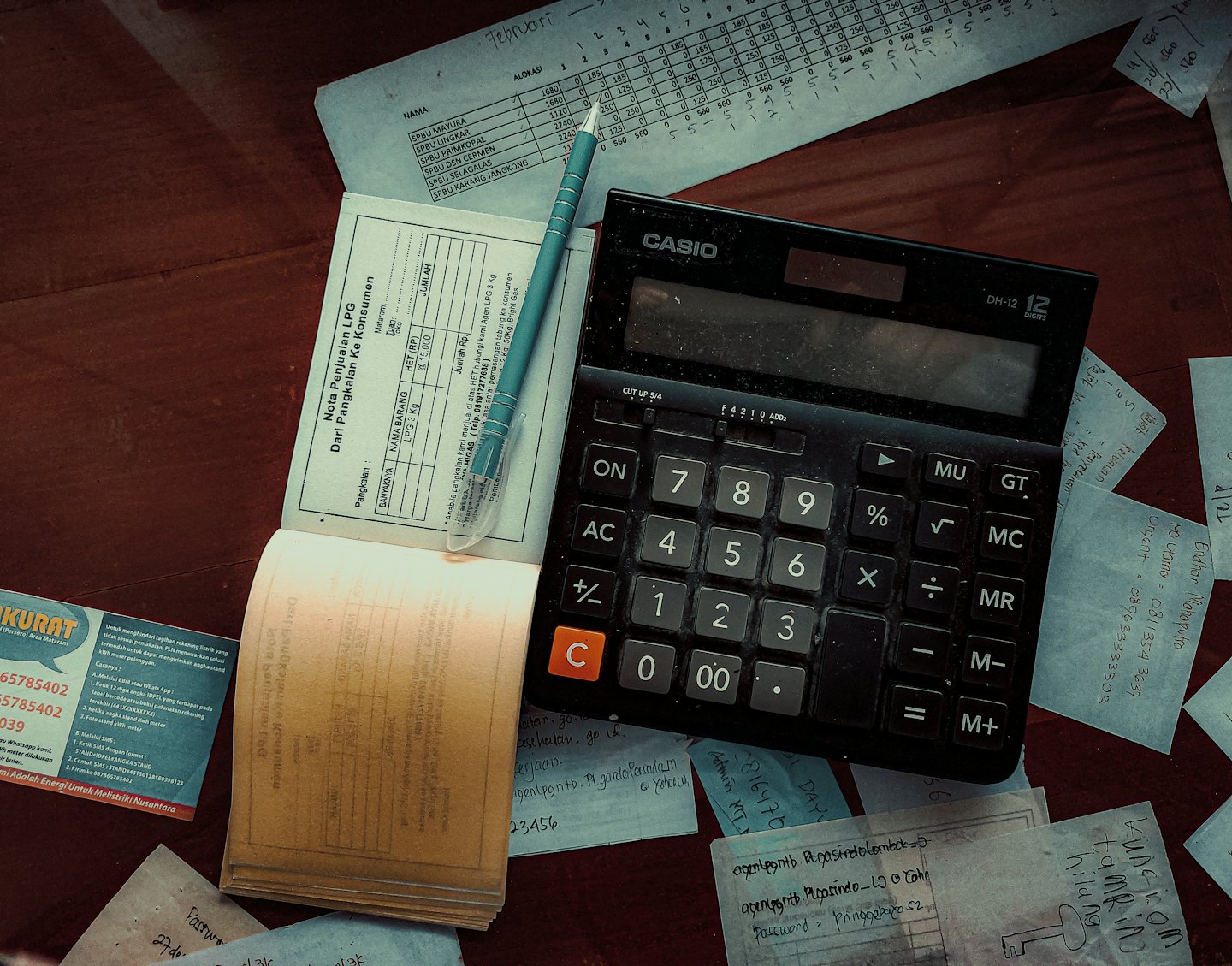

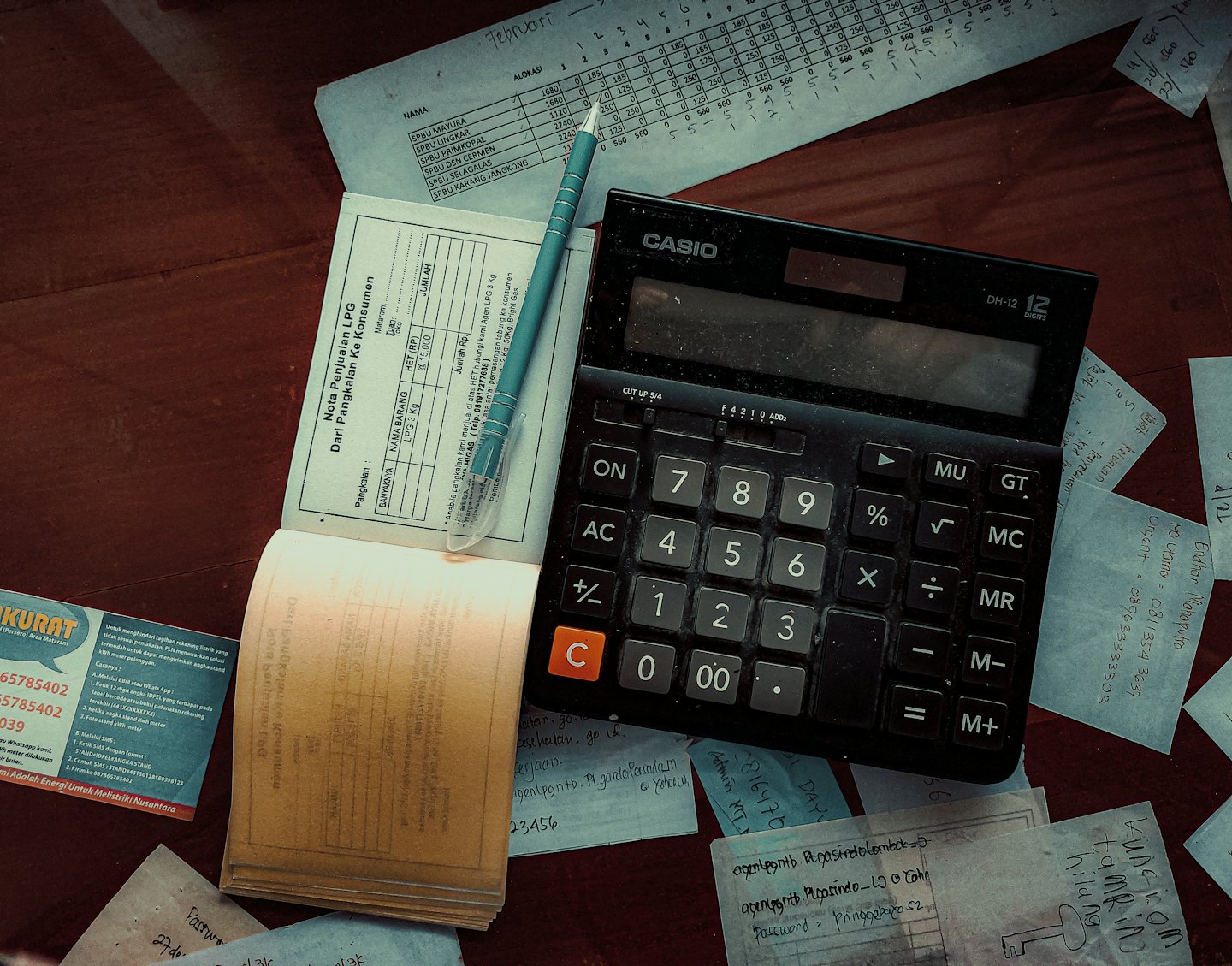

Managing business taxes requires precision, organization, and a thorough understanding of federal and state regulations. At Henriquez Accounting, we provide specialized Business Tax Preparation Services tailored to the needs of LLCs, S Corporations, C Corporations, and Partnerships across the United States. Our goal is to ensure every filing is accurate, compliant, and optimized for maximum tax savings so your business can operate smoothly and efficiently.

Federal and State Tax Filings

Accurate preparation and submission of all required federal and state business tax returns.

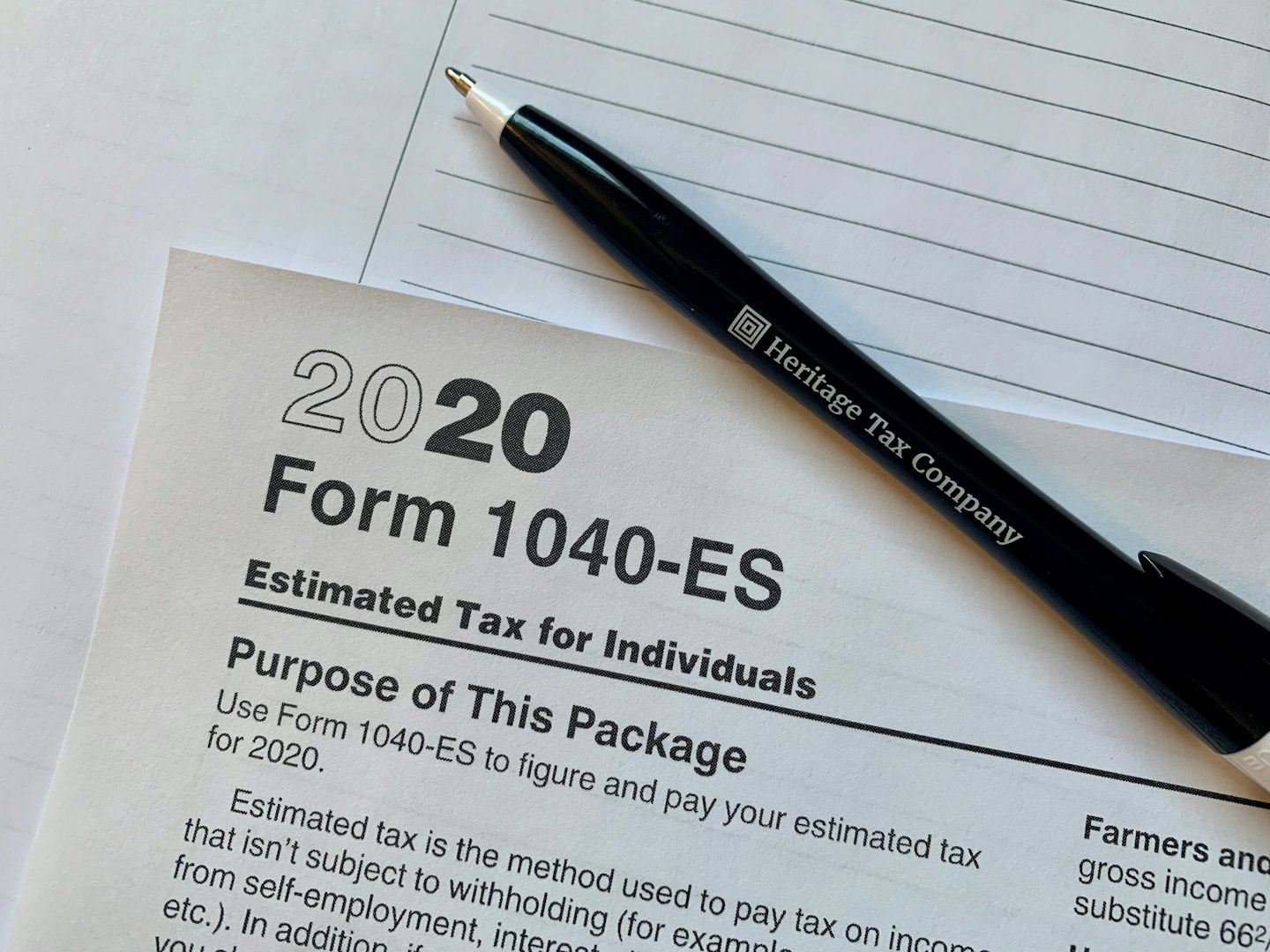

Payroll and Estimated Taxes

Customized payroll tax calculations and timely estimated tax payments to maintain compliance.

IRS Representation & Notices

Professional assistance responding to IRS inquiries and managing audits with expert representation.

Expert Business Tax Preparation Tailored to Your Company

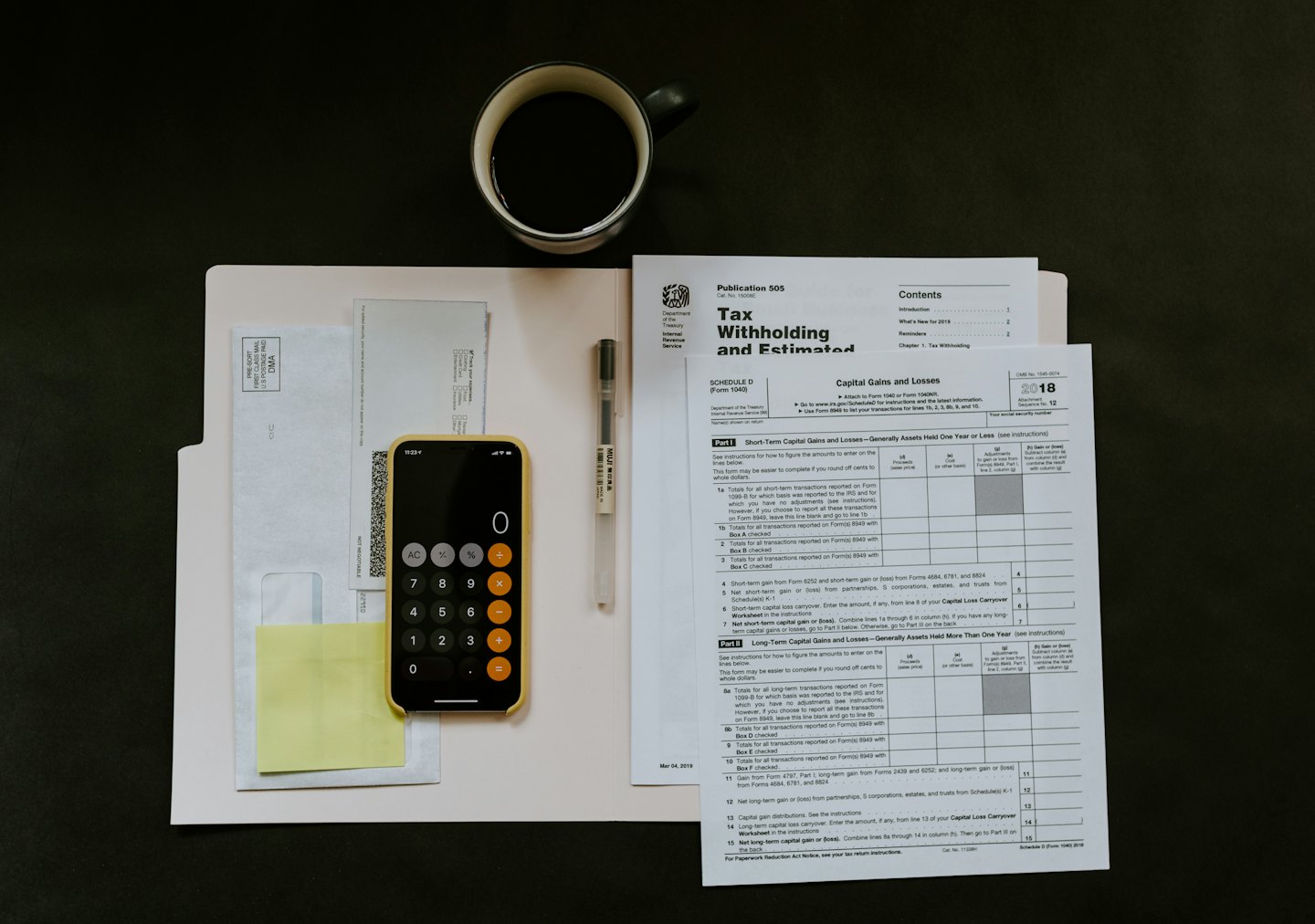

Comprehensive Federal and State Tax Filing

Whether your business operates in a single state or multiple jurisdictions, we ensure all your required tax returns are prepared correctly and submitted on time. We stay updated on changing tax laws and regulations to prevent costly mistakes or penalties. Our team reviews income, expenses, deductions, credits, and adjustments to ensure accuracy and tax efficiency.

We ensure your business remains compliant with current tax laws by referencing the official IRS guidelines.

Learn more directly from the IRS:

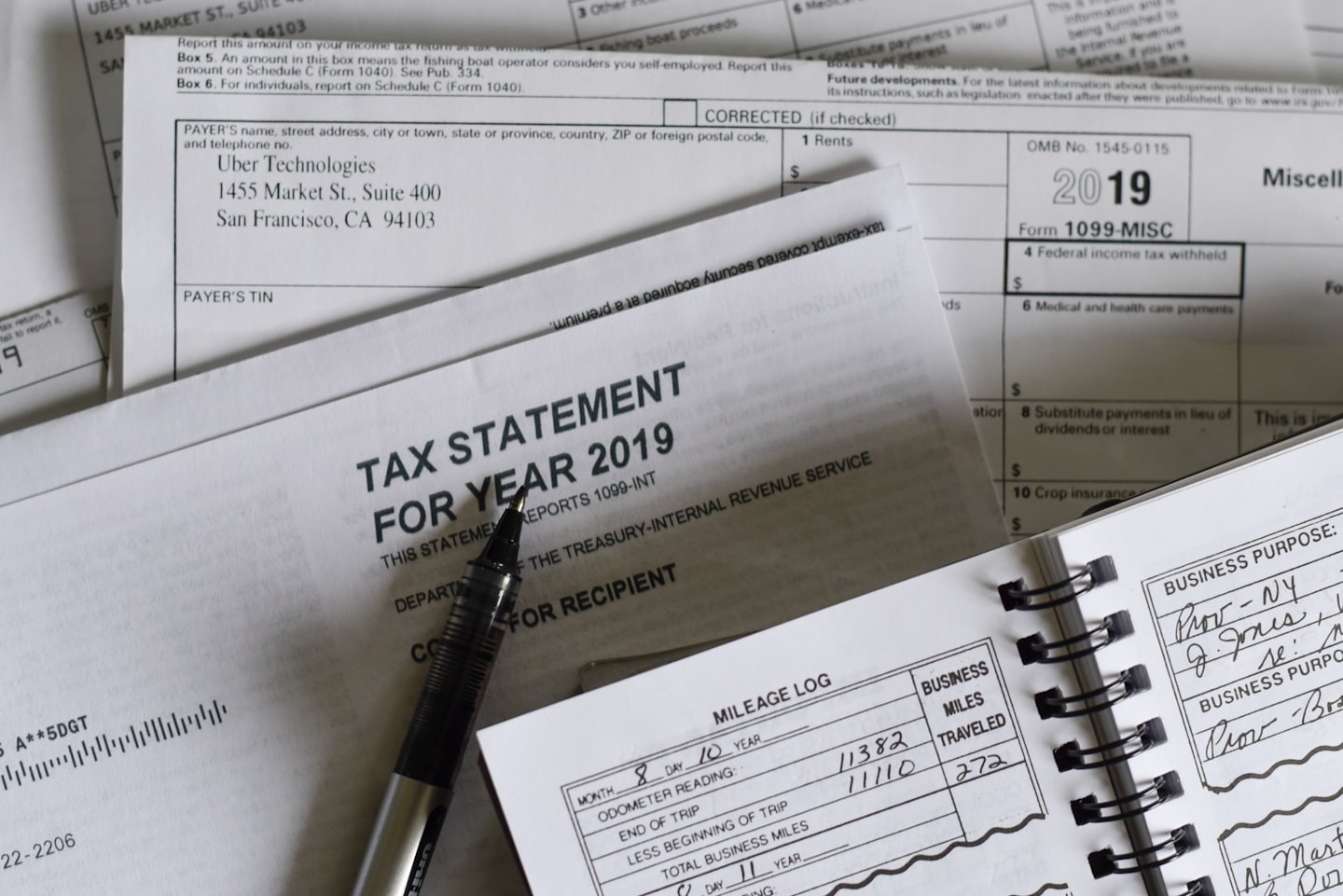

Payroll and Estimated Tax Management

Managing payroll taxes and estimated tax payments can be overwhelming for business owners. We provide complete support including:

- Payroll tax calculations for W-2 employees

- 1099 contractor payments and filings

- Quarterly estimated tax calculations and submissions

- Year-end payroll tax preparation (W-2s & 1099s)

By trusting our experienced team, you avoid underpayment penalties and ensure your employees and contractors receive accurate tax documents.

IRS Representation and Notice Response

If your business receives an IRS notice or becomes the subject of an audit, our firm provides the professional support you need. We communicate with the IRS on your behalf to clarify issues, resolve discrepancies, negotiate payment plans if necessary, and guide you through every step of the audit process. With our representation, you’ll never have to face tax issues alone.

Discover Our Business Tax Preparation Services

Explore tailored tax solutions for LLCs, S Corps, and C Corps. We ensure accurate filings, compliance, and strategic guidance to help your business stay organized and maximize tax savings.

Comprehensive Federal and State Filing

Ensure accurate tax returns with our expert federal and state filing support.

Payroll and Estimated Tax Management

Reliable payroll processing and precise estimated tax calculations.

IRS Representation and Notice Assistance

Professional help in resolving IRS notices and audits efficiently.

Partnership and Corporate Tax Returns

Expert preparation for partnership and corporate tax filings.

Depreciation and Business Deductions Guidance

Maximize savings through strategic depreciation and deduction advice.

Client Testimonials and Success Stories

Read firsthand accounts from our clients, highlighting their trust and positive outcomes working with Henriquez Accounting.

“Henriquez Accounting made tax season seamless with their expert guidance and timely support. Truly professional service!”

Amanda Lee

Small Business Owner

“Their attention to detail and thorough understanding of business tax laws gave me great confidence throughout the process. Highly recommended!”

Michael Torres

Startup Founder

“Every aspect of our tax preparation was handled with care, accuracy, and professionalism. The team’s expertise exceeded our expectations.”

Sophia Patel

Corporate CFO

Why Choose Our Business Tax Preparation Services?

- Tailored solutions for LLCs, S Corps, C Corps, and Partnerships

- Transparent pricing with no hidden fees

- Personalized guidance and year-round support

- Compliance-focused and detail-driven approach

- Experienced tax professionals who care about your success

Ensure Your Business Tax Compliance Today

Avoid costly mistakes and stressful tax seasons. Our Business Tax Preparation Services are designed to give you confidence, clarity, and financial peace of mind.

- Comprehensive Federal and State Tax Filing

- Accurate Payroll and Estimated Tax Calculations

- Professional 1099 and W-2 Filing Services

- Strategic Guidance on Depreciation & Deductions

- IRS Representation and Notice Response Support